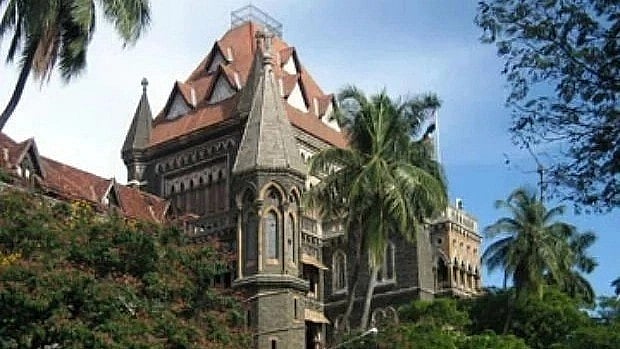

**Bombay High Court Directs Pre-Consultation Notice Before Issuing Service Tax Demands Over Rs 50 Lakh**

*Mumbai:* The Bombay High Court has ruled that tax authorities must issue a pre-consultation notice before serving show cause notices (SCNs) for service tax demands exceeding Rs 50 lakh. This judgment came during the hearing of seven petitions filed by developers, banks, and contractors challenging SCNs issued without prior consultation.

### Petitioners Challenged SCNs Across Sectors

The petitions were filed by notable entities including Rochem Separation Systems (India), Pyramid Developers, Leighton India Contractors Pvt. Ltd., Abhyudaya Co-Operative Bank Ltd., M.R. Realtors, Galaxy Realtors, and Vinod Ranvirsing Vij, proprietor of Clinque Aesthetica. All petitioners contested the validity of SCNs issued by the Service Tax Department without any pre-consultation.

Earlier, on January 30, 2023, the High Court had granted interim relief by staying the SCNs.

### Pre-Consultation: A Mandatory Safeguard

The core issue revolved around whether the pre-consultation process—introduced by the Central Board of Excise and Customs’ (CBEC) Master Circular dated March 10, 2017, and clarified on November 19, 2020—was mandatory under Section 73 of the Finance Act, 1994.

Although the Finance Act itself does not explicitly mention pre-consultation, the CBEC circular mandates this process in cases where tax demands exceed Rs 50 lakh.

### Revenue’s Argument Rejected

The Revenue contended that the absence of pre-consultation would not invalidate the SCNs. However, the court disagreed, noting earlier rulings by several High Courts including Delhi, Gujarat, and Madras that supported the mandatory nature of pre-consultation.

The bench of Justices MS Sonak and Advait Sethna emphasized that pre-consultation is not an “empty formality” but a vital safeguard for businesses. They stated:

> “The requirement has been introduced as an important step towards trade facilitation and promoting voluntary compliance, thereby reducing the need for issuing show cause notices in every case.”

They further observed that during the pre-consultation, “the department may convince the assessee or be convinced itself regarding the necessity or otherwise of raising tax demands.”

Since the SCNs in question were issued without following this mandatory step, the bench quashed them while safeguarding the Revenue’s interests by excluding certain periods from the limitation clock.

### Court Directs Fresh Pre-Consultation Within Six Weeks

While quashing the existing SCNs, the High Court directed the revenue authorities to issue fresh pre-consultation notices within four weeks. Assessees are then required to respond within two weeks, ensuring the entire process concludes within six weeks.

The court stressed that the issuance of SCNs will depend on the outcomes of the fresh pre-consultation notices.

Additionally, it clarified that the period covered by the interim relief (from January 30, 2023) and the pre-consultation process will not count towards the limitation period.

—

*Stay informed on legal updates impacting businesses and tax compliance. For exclusive and budget-friendly property deals in Mumbai and surrounding regions, visit:* [https://budgetproperties.in/](https://budgetproperties.in/)

https://www.freepressjournal.in/mumbai/bombay-hc-rules-pre-consultation-notice-mandatory-before-issuing-service-tax-scns-above-50-lakh