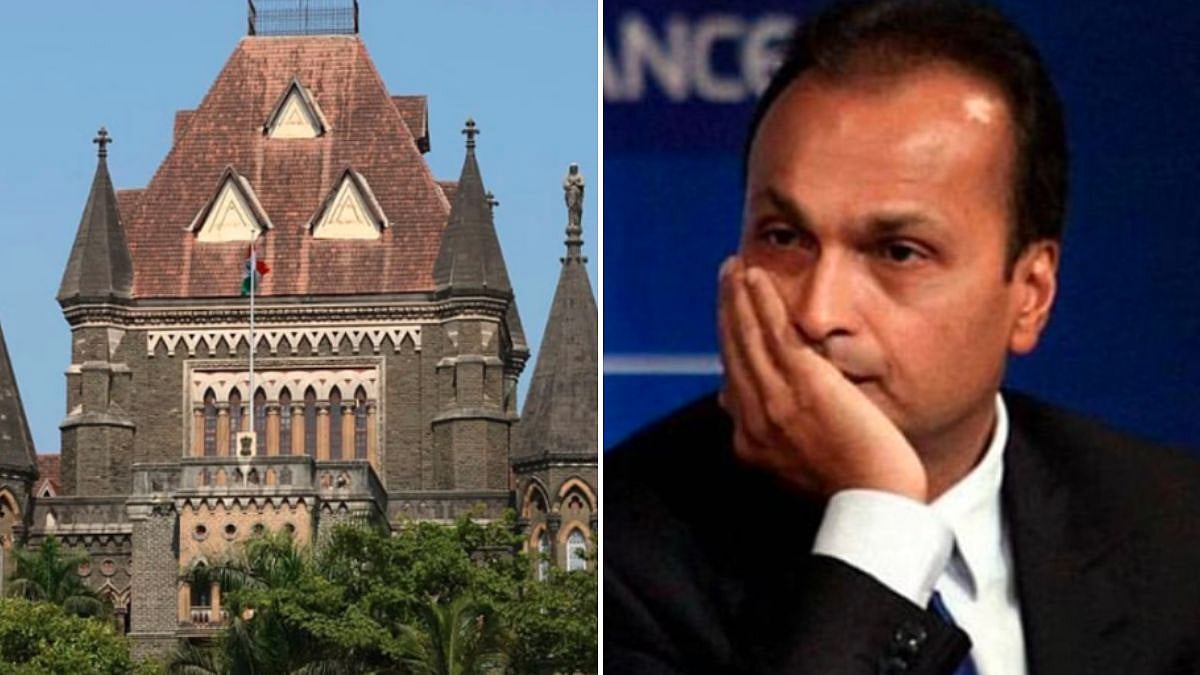

Mumbai: In a significant ruling with wide implications for corporate accountability, the Bombay High Court has held that once a company’s loan account is classified as “fraud,” its promoters and directors in control of the company are automatically liable to penal measures.

The observation came while the court upheld the State Bank of India’s (SBI) decision to declare the account of Reliance Communications (RCom), a firm promoted by industrialist Anil Ambani, as “fraudulent”.

### Petition Dismissed by High Court

A bench of Justices Revati Mohite-Dere and Neela Gokhale, in its October 3 order (made available on Tuesday), dismissed Ambani’s plea challenging SBI’s June 2025 order declaring RCom’s account as “fraud”.

“There is no merit in the petition. Petition is dismissed,” the bench said.

### Promoters and Directors Held Liable

The court emphasised that promoters and directors cannot escape liability merely because they are not named individually in the show-cause notice.

“It is well settled that once the company’s account is classified or declared to be a fraud account, the promoters/directors who were in control of the company are liable to penal measures and to be reported as fraud and debarred from raising funds or seeking credit facilities, as they were responsible for the acts or omissions of the company,” the bench observed in a detailed 46-page order.

### RBI Directions Cited

The judges noted that Ambani was described in RCom’s annual reports as the “promoter” and “person having control” over the company. They further relied on the Reserve Bank of India’s (RBI) Master Directions on Fraud Risk Management (2024), which state that entities and individuals associated with a fraudulent account are barred from accessing credit from financial institutions for five years from the date of repayment or settlement.

### Loans and Defaults

SBI had extended multiple loans and credit facilities to RCom and its group companies between 2012 and 2016, amounting to over Rs 3,600 crore. Following defaults in repayment, RCom’s account was declared a non-performing asset (NPA) in August 2016.

In December 2023, SBI issued a show-cause notice to RCom and copied it to Ambani and four others regarding suspected fraudulent activity.

### Arguments by Counsels

Ambani’s counsel, Darius Khambata, contended that the notice was invalid since it was issued under the superseded 2016 Master Directions, replaced by the 2024 Directions.

However, SBI’s senior counsel Aspi Chinoy argued that the issuance of new directions did not nullify earlier proceedings, a view supported by the RBI’s counsel.

### Court Finds No Infirmity in SBI’s Action

The court agreed with SBI’s position, holding that the bank’s order was “reasoned” and found “no infirmity” in the process.

### CBI Case Registered

Following the classification of RCom’s account as fraudulent, SBI reported the matter to the RBI and the Central Bureau of Investigation (CBI). The CBI has since registered a case against Ambani and RCom for alleged bank fraud of Rs 2,929 crore and conducted searches at his residence and company premises.

—

*For details on exclusive and budget-friendly property deals in Mumbai & surrounding regions, visit:* [https://budgetproperties.in/](https://budgetproperties.in/)

https://www.freepressjournal.in/mumbai/bombay-hc-upholds-sbis-fraud-tag-on-anil-ambanis-reliance-communications-holds-companys-promoters-directors-liable-under-rbi-guidelines