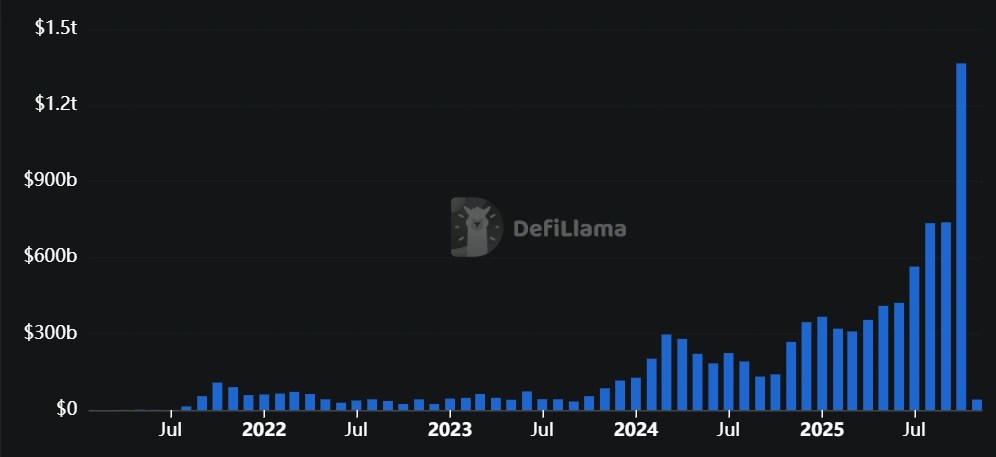

Decentralized Perpetual Futures Surpass $1.3 Trillion in Monthly Trading Volume for the First Time in October

Decentralized perpetual futures have reached a major milestone, with their monthly trading volume in October exceeding $1.3 trillion—nearly double the figures recorded in September. This achievement marks the first time that monthly trading volume on decentralized exchanges (DEXs) has surpassed the $1 trillion threshold, highlighting their growing influence and competition against centralized exchanges (CEXs).

The open interest (OI) in perpetual futures was approximately $17.9 billion during this period. According to DeFi data analytics platform DeFiLlama, the on-chain perpetuals’ monthly trading volume for September stood at over $738 billion. This means DEX perpetual futures almost doubled September’s numbers by hitting $1.3 trillion in October.

_Perps Go from Niche Experiment to Trillion-Dollar Engine_

Perpetual futures—crypto derivatives that allow traders to bet on asset prices without an expiry date—have traditionally been dominated by major centralized exchanges such as Binance, Coinbase, and OKX. However, with increased risk controls and compliance rules imposed on these platforms over the past year, a significant portion of liquidity is shifting on-chain.

Decentralized platforms like Hyperliquid, Lighter, EdgeX, and various others operating on Ethereum and Arbitrum have stepped up to fill the void. Collectively, they handled over a trillion dollars in notional trading volume last month alone.

Juan Pellicer, a researcher at Sentora, explains that this migration to on-chain trading is driven by tighter risk management and reduced market-making activities on centralized exchanges. On-chain protocols have innovated new execution models targeting niche and slower-moving traders—the so-called “long tail” of the market—while also offering greater transparency and composability.

As the Sentora report notes, “On-chain derivatives are no longer a sideshow. They’re now the marginal venue for leverage in crypto, shaping how risk transmits through the system.”

_Fed Rate Cuts Add Fuel to Leverage Demand_

The U.S. Federal Reserve’s recent rate cut—its second this year—has lowered the cost of dollar funding. This development has indirectly boosted leverage appetite across various risk assets, further fueling demand in the perpetual futures market.

—

Source: DeFiLlama, Sentora Research, BitcoinEthereumNews.com

https://bitcoinethereumnews.com/blockchain/decentralized-perpetual-futures-surpassed-1-3-trillion-in-monthly-trading-volume-for-the-first-time-in-october/?utm_source=rss&utm_medium=rss&utm_campaign=decentralized-perpetual-futures-surpassed-1-3-trillion-in-monthly-trading-volume-for-the-first-time-in-october