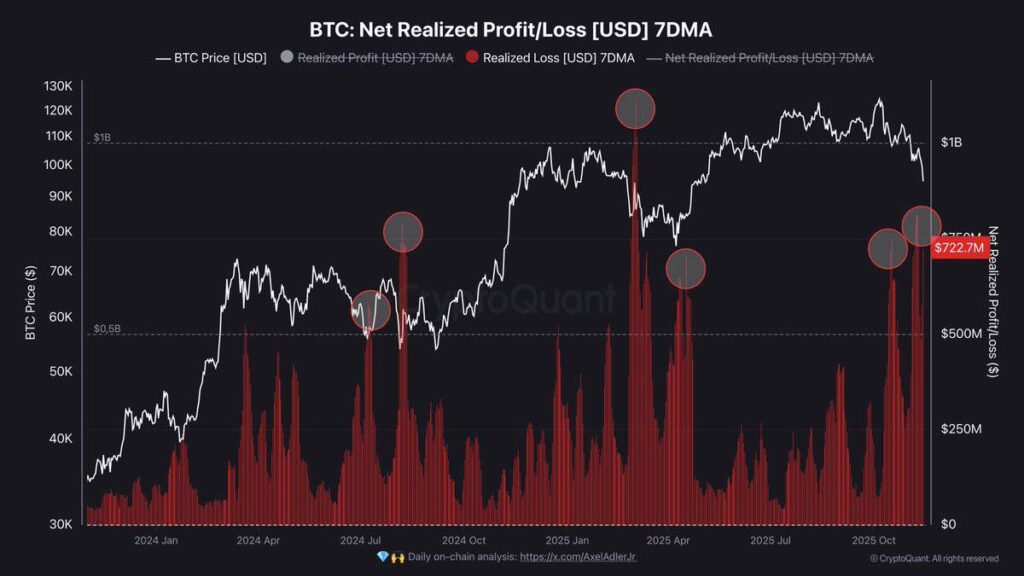

**BTC Realized Losses Hit $722M Last Week Amid Persistent Selling from Long-Term Holders**

Bitcoin (BTC) realized losses reached $722 million in a single week in early 2025, driven largely by sustained selling from long-term holders. These losses have surged near the $1 billion mark multiple times throughout 2024 and into early 2025, underscoring ongoing market declines and volatility.

BTC prices have fluctuated widely between $35,000 and $125,000, with volatility intensifying as holders continue to sell through key support levels. This article explores what BTC realized losses mean in 2025, the evolving trends in volatility and support zones, and what investors should watch for in the current market environment.

—

### What Are BTC Realized Losses and Why Do They Matter in 2025?

BTC realized losses represent the actual financial losses Bitcoin holders incur when they sell their assets below the original purchase price. This metric offers crucial insights into market sentiment and selling pressure.

In early 2025, realized losses surged to $722 million in just one week. This spike was predominantly caused by long-term holders offloading positions amid a retreat from highs near $115,000. This selling pattern echoes previous corrections in 2024 and highlights the asset’s fragility as it tests important support zones around $90,000 to $95,000.

—

### How Have BTC Realized Losses Evolved Through 2024 and Into 2025?

Realized losses for BTC began accelerating in mid-2024. They surpassed $500 million during a price drop from approximately $70,000 to $60,000, marking the onset of heightened market caution.

By late 2024, losses approached nearly $1 billion as Bitcoin corrected from roughly $95,000, reflecting intensified selling during uncertain market conditions. Entering 2025, another spike near $1 billion occurred alongside a decline from nearly $110,000, setting the stage for the recent $722.7 million loss amid a pullback from $115,000 peaks.

According to analyst Darkfrost, these spikes often precede major market corrections. Data shows that long-term holders have contributed significantly—up to 60% of total losses during recent waves—while short-term traders have amplified volatility through rapid transactions.

This evolving pattern highlights a recurring cycle where elevated realized losses correlate with 15-20% price drawdowns, as documented by historical on-chain metrics from platforms like Glassnode.

Expert analysis from Darkfrost emphasizes that these loss events are part of a broader capitulation process, where accumulated selling pressure from long-term holders leads to liquidity shifts. Supporting data also indicates that average weekly realized losses rose by 40% year-over-year into 2025, with institutional flows showing reduced accumulation during these high-loss periods.

This structured pattern provides investors with signals to anticipate potential breaks in support, as losses above $700 million have historically aligned with tests of multi-month lows.

—

### Frequently Asked Questions

**What Causes BTC Realized Losses to Spike in Volatile Markets?**

Realized losses spike when long-term holders sell at a loss to reduce exposure during downturns. Such selling is often triggered by macroeconomic factors or profit-taking after price rallies.

In early 2025, the $722 million surge was driven by persistent selling as BTC prices fell from $115,000. On-chain data reveals around 25% of transactions occurred at a loss compared to previous periods of stability. This heightened selling pressure reflects broader market fear, pushing prices toward key supports like $90,000 without immediate buying interest to stabilize prices.

—

**Will BTC Realized Losses Lead to a Deeper Correction in 2025?**

Based on historical trends, BTC realized losses of this magnitude often signal extended corrections. However, the depth and duration of these declines depend on liquidity flows and holder behavior.

Similar spikes in 2024 preceded further drops of 10-15% before market stabilization. Analysts like Darkfrost advise closely monitoring realized losses over the following weeks to determine whether the current pullback from $115,000 stabilizes near $90,000 or continues lower.

—

### Key Takeaways

– **Realized Losses at $722M:** Indicates intense selling pressure from long-term holders, mirroring 2024 surges that led to notable market corrections.

– **Volatility Between $35K and $125K:** Wide BTC price swings highlight fragile market structure, with realized losses climbing amid reduced signs of stabilization.

– **Monitor Support Levels Closely:** Key support zones around $90,000 to $95,000 are critical. Ongoing realized losses could test deeper supports if no reversal occurs.

—

### Conclusion

As BTC realized losses climb to $722 million in early 2025, market vulnerability is underscored by persistent selling from long-term holders and alignment with past patterns of volatility.

This dynamic, rooted in the major surges of 2024, calls for caution as Bitcoin prices hover near crucial support levels. Investors should stay informed by monitoring on-chain metrics and expert insights from analysts like Darkfrost to navigate potential market corrections. Doing so will be essential for positioning effectively for recovery as liquidity dynamics evolve in the coming months.

https://bitcoinethereumnews.com/bitcoin/bitcoin-realized-losses-hit-722m-as-selling-persists-testing-key-support-levels/